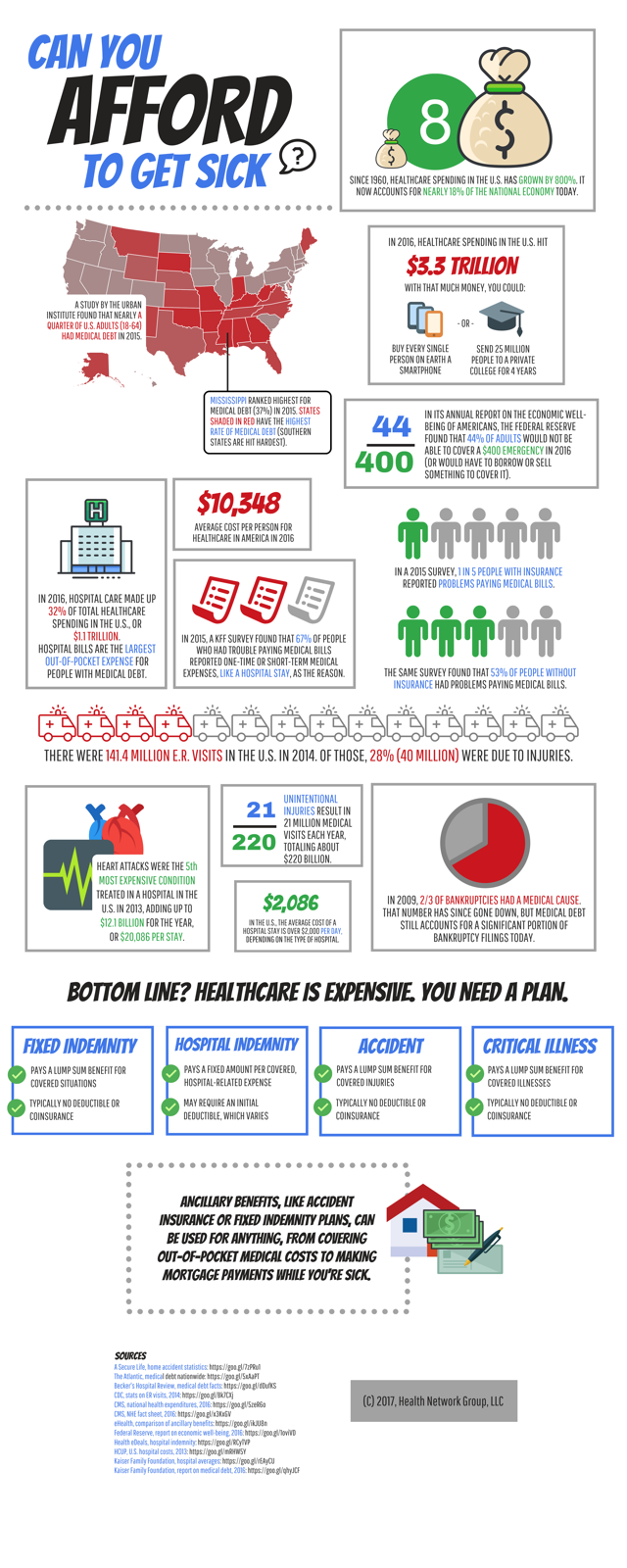

Can You Afford to Get Sick?

A Study by the Urban Institute Found That Nearly a Quarter of U.S. Adults (18-64) Had Medical Debt in 2015. Mississippi Ranked Highest for Medical Debt (37%) in 2015. States Shaded in Red Have the Highest Rate of Medical Debt (Southern States Are Hit Hardest). Since 1960, Healthcare Spending in the U.S. Has Grown by 800%. It Now Accounts for Nearly 18% of the National Economy Today. In 2016, Healthcare Spending in the U.S. Hit $3.3 Trillion With That Much Money, You Could: Buy Every Single Person on Earth a Smartphone or Send 25 Million People to a Private College for 4 Years $10,348 Average Cost Per Person for Healthcare in America in 2016 In 2016, Hospital Care Made Up 32% of Total Healthcare Spending in the U.S., or $1.1 Trillion. Hospital Bills Are the Largest Out-of-pocket Expense for People With Medical Debt. In 2015, a Kff Survey Found That 67% of People Who Had Trouble Paying Medical Bills Reported One-time or Short-term Medical Expenses, Like a Hospital Stay, as the Reason. In a 2015 Survey, 1 in 5 People With Insurance Reported Problems Paying Medical Bills. The Same Survey Found That 53% of People Without Insurance Had Problems Paying Medical Bills.

There Were 141.4 Million e.r. Visits in the U.S. In 2014. Of Those, 28% (40 Million) Were Due to Injuries.

Eart Attacks Were the 5th Most Expensive Condition Treated in a Hospital in the U.S. In 2013, Adding Up to $12.1 Billion for the Year, or $20,086 Per Stay. 21/220 Unintentional Injuries Result in 21 Million Medical Visits Each Year, Totaling About $220 Billion. $2,086 in the U.S., the Average Cost of a Hospital Stay Is Over $2,000 Per Day, Depending on the Type of Hospital. In 2009, 2/3 of Bankruptcies Had a Medical Cause. That Number Has Since Gone Down, but Medical Debt Still Accounts for a Significant Portion of Bankruptcy Filings Today.

Bottom Line? Healthcare Is Expensive. You Need a Plan.

Fixed Indemnity

- Pays a Lump Sum Benefit for Covered Situations

- Typically No Deductible or Coinsurance

Hospital Indemnity

- Pays a Fixed Amount Per Covered, Hospital-related Expense

- May Require an Initial Deductible, Which Varies

Accident

- Pays a Lump Sum Benefit for Covered Injuries

- Typically No Deductible or Coinsurance

Critical Illness

- Pays a Lump Sum Benefit for Covered Illnesses

- Typically No Deductible or Coinsurance

Ancillary Benefits, Like Accident Insurance or Fixed Indemnity Plans, Can Be Used for Anything, From Covering Out-of-pocket Medical Costs to Making Mortgage Payments While You’re Sick.