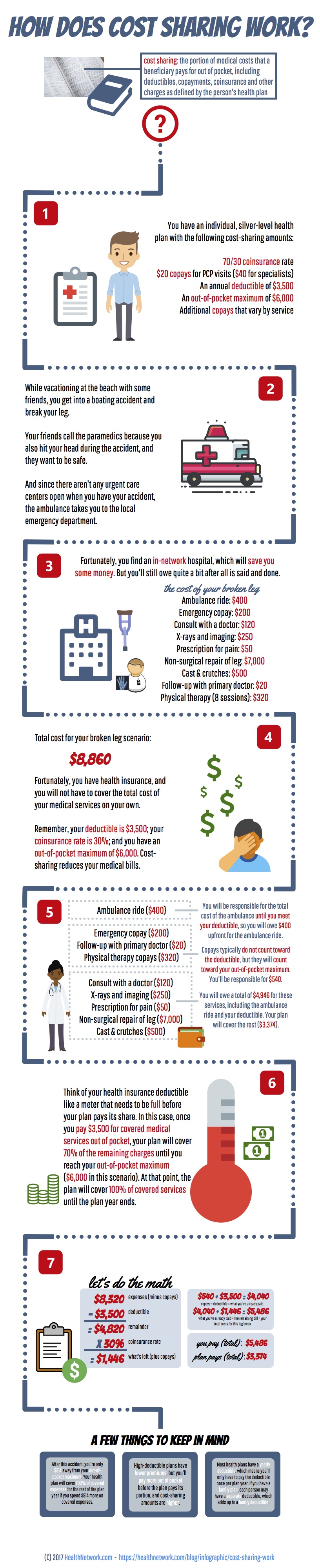

How does cost sharing work?

cost sharing: the portion of medical costs that a beneficiary pays for out of pocket, including deductibles, copayments, coinsurance and other charges as defined by the person’s health plan

You have an individual, silver-level health plan with the following cost-sharing amounts:

- 70/30 coinsurance rate

- $20 copays for PCP visits ($40 for specialists)

- An annual deductible of $3,500

- An out-of-pocket maximum of $6,000

- Additional copays that vary by service

While vacationing at the beach with some friends, you get into a boating accident and break your leg. Your friends call the paramedics because you also hit your head during the accident, and they want to be safe. And since there aren’t any urgent care centers open when you have your accident, the ambulance takes you to the local emergency department.

Fortunately, you find an in-network hospital, which will save you some money. But you’ll still owe quite a bit after all is said and done.

the cost of your broken leg

- Ambulance ride: $400

- Emergency copay: $200

- Consult with a doctor: $120

- X-rays and imaging: $250

- Prescription for pain: $50

- Non-surgical repair of leg: $7,000

- Cast & crutches: $500

- Follow-up with primary doctor: $20

- Physical therapy (8 sessions): $320

Total cost for your broken leg scenario:

$8,860 Fortunately, you have health insurance, and you will not have to cover the total cost of your medical services on your own. Remember, your deductible is $3,500; your coinsurance rate is 30%; and you have an out-of-pocket maximum of $6,000. Cost- sharing reduces your medical bills.

You will be responsible for the total cost of the ambulance until you meet your deductible, so you will owe $400 upfront for the ambulance ride.

- Ambulance ride ($400)

Copays typically do not count toward the deductible, but they will count toward your out-of-pocket maximum. You’ll be responsible for $540.

- Emergency copay ($200)

- Follow-up with primary doctor ($20)

- Physical therapy copays ($320)

You will owe a total of $4,946 for these services, including the ambulance ride and your deductible. Your plan will cover the rest ($3,374).

- Consult with a doctor ($120

- X-rays and imaging ($250)

- Prescription for pain ($50)

- Non-surgical repair of leg ($7,000)

- Cast & crutches ($500)

Think of your health insurance deductible like a meter that needs to be full before your plan pays its share. In this case, once you pay $3,500 for covered medical services out of pocket, your plan will cover 70% of the remaining charges until you reach your out-of-pocket maximum ($6,000 in this scenario). At that point, the plan will cover 100% of covered services until the plan year ends.

Let’s do the math

$8,320 – $3,500 = $4,820 x 30% = $1,446

$540 + $3,500 = $4,040 copays + deductible = what you’ve already paid

$4,040 + $1,446 = $5,486 what you’ve already paid + the remaining bill = your total costs for this leg break

you pay (total) : $5,486

plan pays (total) : $3,374

A few things to keep in mind

After this accident, you’re only $514 away from your out-of- pocket maximum. Your health plan will cover 100% of covered expenses for the rest of the plan year if you spend $514 more on covered expenses. High-deductible plans have lower premiums, but you’ll pay more out of pocket before the plan pays its portion, and cost-sharing amounts are higher. Most health plans have a yearly deductible, which means you’ll only have to pay the deductible once per plan year. If you have a family plan, each person may have a separate deductible, which adds up to a family deductible.