Obamacare RFID Chip

This website has been created to help Americans concerned the Obamacare Chip rumor regarding the affordable care act, also known as “Obamacare” having a specific mandate that requires that every American receive an implantable RFID chip by some specific date, separate Fact from Fiction. First and foremost, the “Obamacare Chip” or the “Obamacare RFID Chip” is 100% fiction.

The Origin Of The Obamacare Chip Hoax

Before the Patient Protection and Affordable Care Act was finalized and passed into law on March 23, 2010, there was a lot of speculation about what this new healthcare reform bill would look like, how it would be carried out and what it would require of the citizens of the United States. Whenever there is uncertainty about something new in culture, the whispers and discussions around the dinner table oftentimes lead to rumors that very easily take on a life of its own. The RFID chip was one such rumor that caused some hysteria, a lot of confusion and, most of all, a lot of opposition to the language of a law that no one had yet seen.

Somehow the rumors about the RFID chip still have legs and are running around the workplace water coolers and our e-mail inboxes with stories about their advancement, the new plans for how to implant every American with their own microchip and even a news story, albeit satire, about the citizens of the small town of Hanna, Wyoming who have been ordered and mandated by their mayor to participate in a RFID chip implant program.

The bottom line is that even though the Affordable Care Act, which is more commonly referred to as Obamacare, is more than 900-pages long and not many people have actually read every word within the bill, there are people who have and they can say with certainty that the law does not propose, suggest or plan to implement any program whereby the government would implant RFID chips into its citizens for any purpose.

Now that we know that this rumor is a hoax, let’s discuss exactly what the rumor is, what a RFID chip is, how the rumor came about, how it has been exploited in the media and what it has to do with the Affordable Care Act in the first place.

What is the RFID Chip rumor?

Prior to the Affordable Care Act actually being passed into law and published for the your reading pleasure, people were desperate to get their hands on any detail leaked to figure out what the final version of the law would require. There was a version of the bill that was written by the House of Representatives on July 14, 2009 (H.R. 3200) and even though that version of the bill never passed secondary review, people embraced some of its language as truth.

In particular, people interpreted a specific section of the H.R. 3200, which was buried at the very end of the drafted bill, as requiring all citizens, including newborn babies, to be implanted with a RFID microchip, which was nicknamed the Medchip. This section of the bill, which is further examined below, stated that under the Affordable Healthcare Act, the government could collect and analyze the data from implanted devices. Despite the fact that the draft of the bill said nothing about any mandate that all citizens be implanted with the Medchip, the media, our local grocer, our grandparents and teachers all took a leap of logic and believed that the Administration was going to mandate that all citizens be implanted with RFID chips.

According to popular but false belief, the government was going to start asking people to line up to be fitted for their very own RFID microchip by March 23, 2013. Articles regarding the impending deadline to be fitted and implanted with an RFID chip were widely circulated by social media, e-mail and website publications. Contained within the section of H.R. 3200 regarding the data collection registry included a deadline to establish and begin operations of the registry within thirty-six (36) months after the draft of the bill was enacted. Considering that H.R. 3200 was never enacted, this deadline and the requirements regarding the registry never went into effect, however it is believe that it was this particular provision of the National Medical Device Registry section that birthed the March 23, 2013 deadline to have the RFID chip implanted. The actual Affordable Care Act was passed into law by President Obama on March 23, 2010 and thirty-six (36) months thereafter would be March 23, 2013; hence, the deadline to be implanted with a RFID chip.

How To Establish That The “Obamacare Chip” Is A Hoax

There are multiple reasons why this information is nonsensical and clearly a hoax. Notwithstanding the fact that the plain and clear language of H.R. 3200, which again was only an early draft of the Affordable Healthcare Act, only created a registry or a deposit place to hold any information collected by certain devices, for which by the way there are thousands of types of devices included in the categories referenced in H.R. 3200, the bill never specifically instructed anyone to be implanted with a RFID chip.

The real point of concern regarding this entire RFID chip rumor is that despite popular opinion that that our government has no reservations about crossing a line to invade our privacy, the fact that people still believe, even today, that the government is comfortable with implanting its citizens, including newborn babies, with a microchip is just absurd. Science, technology, medicine, along with the FDA have not had enough time with the RFID chip to determine whether it is safe, and even if it was definitely determined that an implanted RFID chip under human skin was safe beyond all reasonable doubt today, it seems unlikely that the government would ever force its citizens to be implanted with on in the event that the science was wrong.

The fact of the matter is that even though some people volunteer to have an RFID chip implanted for medical purposes personal to them, the jury is still out as to whether or not there are serious medical consequences with implanting a RFID chip under the skin. In fact, some studies done with mice have actually found that it may cause cancer cells and tumors to grow in size.

To quell the whispers and overt accusations that our government would sneak a mandate into a law requiring citizens to submit to being implanted with a microchip, a few states have opted to pass laws that actually forbid mandatory RFID chips. Therefore, even if our government was brazen enough to try to pass such a law, it would contradict with the laws of certain states and it would be up to the Supreme Court of the United States to determine whether it is the state that has jurisdiction over this issue or whether it is our federal government. Either way, the issue would be squarely in the spotlight and every person across the country would be acutely aware of the issues and the arguments.

What is a RFID Chip?

In order to understand the RFID Chip rumor, you first need to know what a RFID chip is, its function and how it works. RFID stands for a radio-frequency identification. A RFID device is wireless and when implanted someplace, it will utilize a radio-frequency electromagnetic field to transmit data to the receiver.

The concept of the RFID chip was routed in an espionage tool created by the Soviet Union in 1945. This tool transmitted radio waves with audio information after listening in to a conversation. The transponder that was heavily used during World War II to identify aircraft as friend or foe is also credited as being a predecessor to the RFID chip technology.

In 1973, a man named Mario Cardullo created and patented a device that was a passive radio transponder that had a 16-bit memory system. Cardullo created the device with the intent that it could be used in banking as an electronic credit card or check card, in transportation as a tolling system, electronic license plate or vehicle performance monitor, in security for a personal identification system or for surveillance, or in the medical industry to gather patient information. Another perk of the original design of the RFID chip, which carried on to the present but with more improvement in design, was that it was supposed to be small enough that it could be easily hidden and was certainly portable and able to be placed in or on different objects.

Cardullo originally pitched the idea to the New York Port Authority in 1971 as a way to automate the toll collection process. The Port authority listened to the pitch and responded that they did not believe the idea was viable, that people would put the device on their cars and that it would certainly lead to an invasion of privacy. A few years later, the Port Authority jumped on the RFID chip bandwagon and contracted with General Electric to test a device similar to Cardullo’s.

As is typical in many industries, it’s usually the small guy that creates the idea, but the big guy who brings it to the masses. In the case of the RFID chip, although Mario Cardullo is generally credited as creating and patenting the first RFID chip, it was companies like General Electric and RCA who developed it over the years brought and made it accessible and useful to different industries.

The RFID chip industry is vast and expansive and worth billions of dollars. It is estimated that the RFID market around the world could hit $9.2 billion in 2014. RFID chips are used in almost every facet of commerce across the globe and its uses are being expanded to fit the needs of new customers every single day.

The RFID market has really expanded, particularly in the last five years at which time the market has nearly doubled in value. Although there’s no relation in time to the Obamacare Act, the technology over the past five years has improved greatly in design. The RFID chip of today’s market is smaller, thinner, is more powerful, has a longer transmission range, has more memory and is, most importantly, cheaper. A cheaper product with more functionality and usability means that more industries, including the small business owner, can take advantage of the RFID chip’s offering to improve business or open up doors to new business opportunities.

Today, consumers can find RFID chips everywhere in their life. For instance your access pass to get into your office suite may have a RFID chip that identifies who you are, when you leave and when you arrive. RFID chips are sometimes used to track products from stores too. For instance, clothing stores can place RFID trackers on clothes to track when they are stolen or purchased, worn and then returned. Most of us know of someone who will purchase an expensive clothing item for a special event, hide the tags, wear the outfit, clean it, and then return it. It has been a big problem for major retailers for many years.

In addition, manufacturers are experimenting with placing RFID chips on promotional items to track whether a store ultimately sold the product at a discounted rate or whether customers are still willing to pay full price. Walmart in the early 2000’s considered using RFID chips in just about everything in order to better manage their supply chain and make their stores more cost efficient. Unfortunately the cost of RFID tags never got to a point where it would make financial sense, so for the most part WalMart has since abandoned the idea, despite what some other hoaxes piggybacking off of the Obamacare Chip hoax might lead you to believe.

RFID chips are not just for goods in commerce though. Farmers have been affixing RFID chips on their livestock for years to locate their whereabouts. Families are oftentimes encouraged to have their pets implanted with the RFID chip in the event they run away s well.

RFID chips have revolutionized the industry of logistics and transportation because an importer, exporter or inter-state shipper can now track the location of something as big as a shipping container or the individual items being shipped within to approximate the date and time of arrival. RFID chips also make the process of sorting a large number of goods destined for different locations much easier as well.

In October 2004, the Federal Food and Drug Administration (FDA) approved the first RFID chip that can be implanted into the humans. This chip was designed by a company called VeriChip Corp. VeriChip designed the chip and intended for it to be used to house a person’s medical history. The company believed that having a person’s medical history readily available would limit future injuries caused by error from not having all of the facts on a patient. VeriChip was ultimately rebranded to PositiveID. Their product and marketing was short-lived, partially due to the fact that the public was so against its application and insertion. The company ceased marketing and manufacturing the device, which was about the length of a quarter and typically imbedded in the arm ad under the skin between the shoulder and elbow, in 2010.

Even though the VeriChip Corp.’s RFID chip is no longer manufactured, the RFID chip is still being imbedded into humans to monitor patients. The FDA admits that there are serious health consequences associated with RFID chips that are implanted in the body. For instances, the radio frequencies transmitted can interfere with pacemakers, internal cardio defibrillators or other electronic medical devices placed in the body.

The FDA also freely admits that despite the controversies, they are curious and are always studying the RFID chip and the potential benefits and disadvantages to using them in medicine.

Where did the RFID Chip rumor come from?

As the saying goes, there’s a grain of truth in every rumor told and the RFID chip rumor is no exception. A very early version of the Affordable Care Act bill (H.R. 3200), which was drafted on July 14, 2009 in the House of Representatives, included a section under the heading of “Other Provisions” regarding the National Medical Device Registry. This registry would function under the Federal Food, Drug, and Cosmetic Act and by the Food and Drug Administration (FDA) and, had the H.R. 3200 version of the Affordable Care Act was passed, would consequently also cause the Federal Food, Drug and Cosmetic Act to be amended to then place the National Medical Device Registry under its jurisdiction.

The explanation of what the registry would do and how it would function in the H.R. 3200 draft of the bill is the reason that the RFID chip rumor was fostered. The actual language of the bill says that the rumor would “facilitate analysis of postmarket safety and outcomes data on each device that” are used in a patient and is of a class “that is implantable, life-supporting, or life-sustaining.” (Emphasis added.) Here is the actual language of this portion of the H.R. 3200 bill. The entire bill can be viewed by clicking here.

21 “(g)(1) The Secretary shall establish a national med-

22 ical device registry (in this subsection referred to as the

23 ‘registry’) to facilitate analysis of postmarket safety and

24 outcomes data on each device that—

25“(A) is or has been used in or on a patient; and

1“(B) is—

2 ‘‘(i) a class III device; or

3 ‘‘(ii) a class II device that is implantable,

4 life-supporting, or life-sustaining.

Although the phrase “device that is implantable” does seem to imply RFID chip, it is the fact that a Class II medical device would include a RFID chip, among many other things, that gave the rumors that spawned from this section of the drafted bill wings. There are many other types of devices that would qualify as a Class II medical device other than just RFID chips though. Other examples would be implanted staples, long-term catheters, joint prostheses and gastrointestinal tubes to name a few.

In plain terms, this particular section of the bill says that they would assist in the analysis and review of date that came from devices implanted in patients. This section of the bill goes on to explain that the registry could also collect the serial and model numbers of these devices, how they would collect the data, how they would protect the data, and how they would use the data gathered from the patient’s implanted devices.

The final draft of the Affordable Care Act, which was dated January 5, 2010, did not even include a section called “Other Provisions”. Although there is a section regarding patient-centered research that relates to the creation of an Institute that would aid in the research and discovery of evidence to better science and medicine, it is not at all related to provision included in H.R. 3200. In fact, the term “implant” was carefully erased from the 906-page document that we now call Obamacare.

Although many people who heard about or learned of the National Medical Device Registry section of H.R. 3200 may have actually taken the initiative to look this draft of the Affordable Care Act up on the internet to actually read the language for themselves, but unfortunately many more people chose to blindly believe the rumor without doing the research. What’s worse than simply believing a rumor is proliferating the rumor, and that’s what many obedient believes of the Obamacare chip rumor did; they told as many people as would listen.

Don’t Take Our Word For It, Even Snopes.com Has Stated That The Obamacare Chip Is A Hoax

Snopes.com, which is a website that dispels rumors from pop culture got ahold of an e-mail from March 2012 that discussed the alleged mandatory RFID chip program and also referenced the impending March 23, 2013 deadline as well. The e-mail also warned that in addition to supplying your medical history, the RFID chip would also provide the government with all of your personal information, including your bank accounts and will be used to track our movements and location. This e-mail is largely considered to be from an “anonymous” source.

A second e-mail collected by Snopes.com in March 2010 discusses H.R. 3200 and the section regarding the collection of data taken from devices, including class II and class III devises, and the deposit of that data into a national registry. An example of a class II device is a radio frequency transponder like the RFID chip. The e-mail then goes on to state as fact, without any basis mind you, that anyone who “opts” to sign up for healthcare under the new healthcare reform bill, the Affordable Care Act, will have to get a RFID chip implanted under their skin.

The author of the e-mail presupposes that many people will choose to sign up for the “public option” and get healthcare through Obamacare because the premiums and policies offered by private insurance companies charge “outrageous rates” so that most people cannot afford coverage. The e-mail goes on to say any family with children receiving coverage through CHIP (Children’s Health Insurance Program), will have to implant their kids with microchips and even though parents with private healthcare coverage will not be mandated to comply, they will likely volunteer their kids to be implanted anyhow. The e-mailer believed that eventually everyone would be implanted with an Obamacare chip and that the public healthcare option would also lead to the demise of private health insurance companies. It’s not clear from the e-mail whether the author of this e-mail was referring to Medicaid when referencing the “public option” or whether he or she actually believed that the Affordable Care Act was creating an insurance company. Either way, it does not warrant further discussion.

It is especially discouraging and honestly despicable that someone would associate the Children’s Health Insurance Program or CHIP program that is in place in all states, with this false rumor. Essentially the individuals responsible for trying to create a connection between this Obamacare RFID Chip rumor and the Children’s Health Insurance Program, which is responsible for the healthcare and benefit of millions of children living in poverty, are placing their political ideology and disliking of the current president over the healthcare of children.

These e-mails are examples of the type of information that was spread amongst friends, colleagues and family families to foster the Obamacare chip hoax.

It’s impossible to point a finger at the first person who read the National Medical Device Registry section of H.R. 3200 and decided that it mandated all citizens to be implanted with RFID chips so that the government could collect, analyze and deposit personal information about everyone for all time; however it a little easier to point to the origin of the idea of a government implanting their citizens with a microchip. Even if we could definitively identify who is ultimately responsible, giving them credit is not even something we would do. You would not reward a dog when it makes a mess on the carpet, we believe the same principle applies here as well.

The Biblical Connection Another Cheap Attempt To Profit From Spreading Fear And Lies

Paired with every Presidential proposition for healthcare reform is a rumor regarding the RFID chip. Obviously these rumors really only go back to President Clinton’s administration in large part due to the fact that the RFID chip did not become advanced enough until that point in time to be even remotely plausible. Notwithstanding the science, the concept of implanting a monitoring device into people actually dates back to the Bible with Revelation 13:16-18. In particular, the Book of Revelation 13:16 says: “And he causeth all, both small and great, rich and poor, free and bond, to receive a mark in their right hand, or in their foreheads.” Translated, this verse seems to imply that every person will receive a mark in their hand or in their forehead. The “mark” is easily translated to a RFID device to those looking to scripture for substantiation.

How Those Responsible For The Obamacare Chip Hoax Exploited The Internet In Order To Spread The Rumor

People love a good gossip story and a rumor that President Obama slipped a mandate into the Affordable Care Act that required everyone to be implanted with a RFID chip is definitely a compelling story, which is why it was widely discussed on social media, e-mail exchanges, blogs and websites.

Here are some examples of how people exploited the RFID chip hoax on the Internet.

The National Report, which has been described as a Right Wing version of the humorist website, The Onion, posted an article in July 2013 that reported that the mayor of Hanna, Wyoming was requiring his citizens who were receiving government assistance to be the first to be implanted with a microchip or else they would be terminated from their job and would lose their public assistance. The article did not say that this town’s new program was related to Obamacare, but the article said that the RFID chip program in this small town is just a step towards ensuring the security of nation. Important Note: The National Report is a spoofing website and nothing in this article is actual factual. Readers who do not know this fact, will believe that the information is truthful and the rumors will proliferate.

The Facebook Page for Christians Against Obama’s Re-Election posted the picture below on February 8, 2013 and warned of the impending microchip implantation date of March 23, 2013. The post asked people to tell as many people as possible about the story and to speak out against the Obamacare chip and was liked by 1,820 people, shared by 19,836 people and had 5,322 comments.

There were also multiple videos posted on YouTube about different governments across the world implanting their citizens with RFID chips. Here is one video story from the Philippines.

Fox News discussed with Ron Paul the possibility of identification cards or a scan that would be placed in the back of someone’s hand that would help the government identify whether a person is in the country legally or not. Again, this national identification program is not directly related to Obamacare but the concept of using RFID chips, either on a card or implanted in your hand stems from H.R. 3200. Ron Paul has never officially said that he believes that there is actually a government program and when he made this comment on the Fox News segment, it was simply a measure to spread fear and mistrust when the Affordable Care Act, which is already responsible for saving the lives of tens of thousands of American citizens being criticized before its launch.

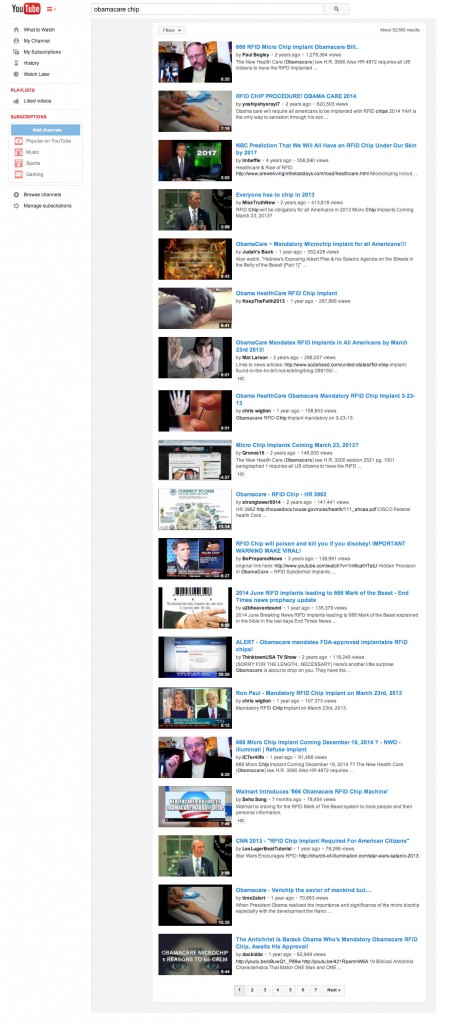

A person can find endless videos on YouTube that debate or inform viewers about the alleged Obamacare chip program. All of these videos claim to have definitive evidence which after viewing th see videos in their entirety, the “evidence” is never revealed. Some of these videos are upwards of two hours long.

Another website posted a recording of a pastor who was preaching to his congregation and recounted the story of an encounter with another pastor who was implanted with a RFID chip and despite popular belief, did not have a the Mark of the Beast described in the Bible.

Brian Williams reported a story very recently that projected that most products in commerce will have RFID chips by 2017. Of course, many websites including the below website interpreted that report as meaning that all people would also be fitted with an RFID chip by 2017 as well.

www.americasfreedomfighters.com

Why Would So Many People Create These YouTube Videos Claiming The Obamacare Chip To Be True If It Wasn’t?

The sad truth is that it is quite simple, money. How exactly do people make money from spreading hoaxes and creating these elaborate rumors? It is incredibly easy YouTube content creators, also known as the individuals who are posting this content, they can make a pretty good living simply from creating low quality video content that does not have to be accurate or even have a point. In fact, the longer the videos are, and the longer the person viewing the video watches, the more money the video creator will make.

YouTube runs advertising on almost all of the submitted content now. On average, a YouTube content creator will receive about $4 for every 1,000 video views. Now that might not sound like a lot of money, or you might be thinking that it is probably pretty difficult to get to 1,000 views in the first place. In reality it really is not that difficult at all. Especially when you consider that many of these videos are linked to within the emails that are sent out in SPAM email messages and forwarded by people who think that the Obamacare Chip rumor is real.

Let’s look at the top results on YouTube for “Obamacare Chip” and calculate approximately how much money these individuals might be receiving for posting this content.

If we look at the most viewed videos on YouTube for “Obamacare Chip”. Within the first page of the results, of the more than 57,000 videos, the top results have been viewed more than 5 million times. That’s more than $20,000 that these hoax spreading content creators are making off of YouTube advertising.

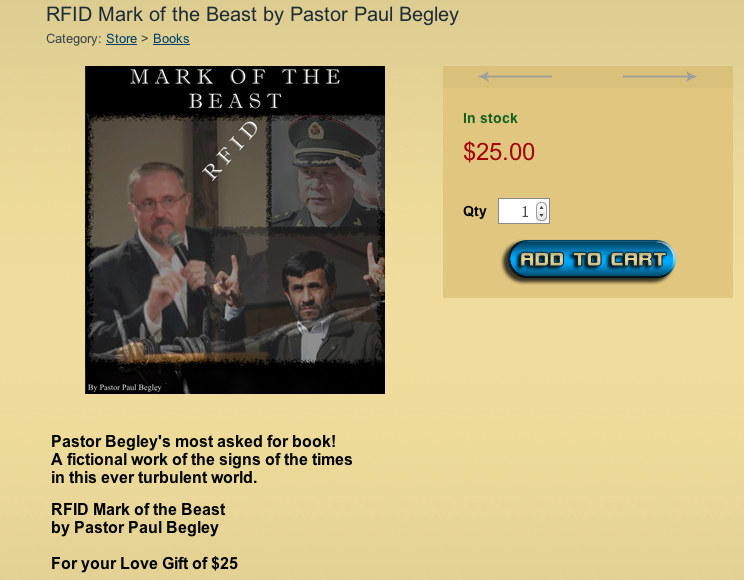

One very interesting thing to note, is that the most viewed result, with more than 1.2 million views, comes from a gentleman named Paul Begley. Not only has Paul posted this same video not once but twice within YouTube, but he’s also selling a book called, “Mark Of The Beast RFID” on his personal website which is linked to within each video. Ironically enough, Paul seems to find it necessary to mention within the description of his website, that this book, which his video would have you believe to be true, is called a Fictional Work. So if the book is fictional, does that mean that the video is as well? Logic would say yes, but cash is king, so it is preferred that you not pay that close of attention to the facts.

Interestingly it seems according to Mr. Begley’s website, that the YouTube promotional videos seem to be helping the book sales. The description within the website says that this book is his most requested.

While we can certainly admire his entrepreneurial efforts to find “creative” ways to promote his fictional book, this is clearly an example of someone profiting from spreading false information.

Some of the other issues that seem to plague many of the Obamacare Chip videos, is that many of them are simply news clips of President Obama giving a speech on something completely unrelated to Obamacare. This approach involves finding a press event where the president makes and speech on any subject, and then uploading the entire clip to YouTube. The goal is to upload a video that looks like it could be legitimate but in all reality is simply a long video that most people won’t even sit through in its entirety. To the person who uploaded the video, it doesn’t matter. They get paid regardless, because you have to sit through the commercial to view the video anyway. The #4 most viewed video in that list with more than 400,000 views, uploaded by MissTruthNew is a speech that’s not even related to the Affordable Care Act. Many of the comments left by viewers ask precisely what this video clip has to do with Obamacare. MissNewTruth doesn’t provide an answer and it’s doubtful that she even cares. It doesn’t matter that 400,000 people just wasted a significant amount of time watching the video. Most likely this person made approximately $1,600 ($4 for every 1,000 views) by uploading a random news clip and then tagging it with the keywords “Obamacare Chip”. If you think about it, the amount of time required for this person to pull a video clip, upload it to YouTube, create a title, add some keywords and if they were really wanting to put some effort in, SPAM 500,000 people, is probably less than an hour. Not too bad, $1,600 in exchange for one hour or less of work.

The rest of the 57,000 videos are all similar in nature, no substance, no facts, just unsubstantiated rumors all of which are generating money for the creators. Also amongst the videos are ones that don’t exactly comes across as either professional or factual, in fact they border on being labeled as something that the guy wearing the sandwich board that says, “the end is nigh” might have produced.

Is this the kind of person that you should be getting your information from?

What does the RFID Chip rumor have to do with Obamacare in the first place?

So how was the National Medical Device Registry and the mandate described in H.R. 3200 that a registry be created to gather, deposit and analyze information gathered from devices, implemented in the final version of the Affordable Care Act that was actually signed into law on March 23, 2010? It wasn’t. When H.R. 3590 was drafted on January 5, 2010 it did not contain the phrase “National Medical Device Registry” or the words “implant” or “implantable”. When H.R. 3590 was signed by President Obama and officially became law, those words and phrase were still absent from the 906-page document.

Despite the fact that the bill was signed into law without any mention of the RFID chip, class II devices that are implantable and the thirty-six (36) month deadline to establish and operate the registry, the rumor lived on and affected the legitimacy of Obamacare. Many people continued to oppose the regulations imposed on them under the Affordable Care Act because they believed the government was trying to pull a fast one over on them and hid the RFID chip requirements somewhere in H.R. 3590. Obviously, this was simply not true.

As a result, many people chose not to follow the law and did not sign up for health insurance coverage that met a minimum standard as required and essentially chose to break the law because of a baseless rumor spread primarily on the internet that had absolutely no merit and substantiation in fact from the moment that it was first discussed.

For those of you reading this article who believed in 2010 and still believe today that the Administration is going to force you to be implanted with a RFID chip and is trying to do so through the Affordable Care Act and as a result, you chose not to sign up for insurance, here are the details of the law you are violating.

What is the history of healthcare reform in the United States and where did Obamacare come from?

We know that H.R. 3590, which is the version of the Affordable Care Act that was ultimately signed by President Obama, was signed into law on March 23, 2010. The law, which has now been dubbed as Obamacare, is designed to reform healthcare, which was in desperate need of an overhaul. For decades, people have complained that the costs of keeping a good insurance policy and receiving healthcare have increased at a rate that is not proportionate to the services they are receiving. Unfortunately, this was caused by the fact that our parents and grandparents are living longer and that the private insurance industry was not being closely watched and had a lot of autonomy to determine policy rules and rates.

Although it was President Obama who ordered and signed the Affordable Care Act, there were many Presidents before him that fought and oftentimes won battles for healthcare reform. In 1965, President Lyndon B. Johnson passed the law that created Medicare, which is healthcare for our citizens over the age of 65, people receiving benefits from Social Security or the Railroad Retirement Board and people with certain diseases. This same law also established Medicaid in the United States, which is healthcare for low-income people.

President Nixon wanted to improve the availability of healthcare to people of all financial classes and asked Congress to bring him a bill that would provide more people access to affordable insurance, nationwide. Unfortunately, President Nixon was unable to pass this type of reforming bill. Nixon was able to sign an amendment to the Social Security Act in 1972 that extended the eligibility requirements of Medicare.

President Carter proposed healthcare reform features that were pulled from a national health insurance bill drafted in 1971 by Massachusetts Democratic Senator Ted Kennedy. Unfortunately no law was ever signed.

President Bill Clinton, along with the First Lady Hilary Clinton, were strong and loud proponents of healthcare reform and although he drafted a healthcare plan in 1993, which required all citizens and legal resident aliens to have adequate healthcare at all times and included provisions that would cap out-of-pocket expenses for participants, the law was never accepted by Congress.

President George W. Bush signed a law for Medicare reform during his presidency. This Medicare bill provided for a prescription drug plan for Medicare participants. The bill is now commonly referred to as Medicare Part D.

In 2006, Massachusetts passed a healthcare reform law that provided health insurance to nearly all of its residents. The law required its citizens to sign up for a health insurance policy that offered a minimum level of coverage, offered free insurance to people who made less than 150% of the federal poverty level and mandated employers with more than 10 full-time employees to offer health insurance. This law was referred to as Romneycare after the state’s sitting governor, Governor Mitt Romney, who championed its passing. Although this version of the law was amended several times over the years and now mirrors the Affordable Care Act’s requirements, it is credited as the inspiration behind President Obama’s Affordable Care Act.

What are the requirements and implications of violating Obamacare?

An person living in the United State will have to be aware of many different requirements of the Affordable Care Act, depending on that person’s circumstances. For instance, if the person is a business owner, they will need to be aware of the requirements imposed on business owners with full-time employees. If the person is considered low-income, he or she would need to be aware of the requirements to receive federal subsidy help to pay for health coverage and the Medicaid and CHIP programs. If the person has a child under the age of 26 years old, he or she would need to be aware the exceptions to the Affordable Care Act. And if the person is presently uninsured, he or she will have to be aware of the deadlines to obtain health coverage and the tax penalty if they do not comply with the law in time.

Let’s now discuss the Affordable Care Act requirements on a person who is presently uninsured because, as stated previously, if you’re reading this article and chose not to comply with the Affordable Care Act because you believed that it cause you to be implanted with a RFID chip under the alleged Obamacare chip program, this is the section that is probably most relevant to you.

The actual language of H.R. 3590 states that if a person does not get health insurance that meets a minimum standard by the deadline imposed, they will be taxed with a Shared Responsibility Payment. The Shared Responsibility Payment is more commonly referred to as the Individual Mandate.

For the 2014 calendar year, the law said that unless a person already had insurance coverage through their employer or already had a private healthcare policy that included the minimum essential requirements, or unless a person was exempt from getting health insurance under of the law, both of which will be discussed in further detail below, they needed to sign up for health insurance by March 31, 2014. Unless the person qualified for a special enrollment period at some point in time after the March 31, 2014 deadline, which would include getting married or divorced, losing your insurance policy, moving to another state, having or adopting a child or experiencing a technical difficulty or some other specific circumstance that caused you to not be able to sign up in time, you would be taxed for violating the law.

The issue of whether President Obama could impose a tax under the Individual Mandate provision of the Affordable Healthcare Act and if it was constitutional was reviewed by the Supreme Court of the United States, who held in June 2012 that the tax was constitutional and permitted under the government’s power to tax its citizens.

After the 2014 open enrollment period closed on March 31, 2014, more than eight-million people were able to call themselves insured individuals. For the millions of people who chose not to get insurance by the 2014 deadline they will be taxed for not complying with the law and should prepare to sign up for insurance during the 2015 open enrollment period, which starts on November 15, 2014 and closes on February 15, 2015. The 2016 and 2017 open enrollment periods should be similar spans of time.

For the 2014 calendar year, the Affordable Care Act mandates that the tax will be either 1% of the yearly household income, which is determined by taking the yearly income for the entire family and subtracting the first $10,150.00, which is the tax-filing threshold, or $95.00 per adult and $47.50 per child in the family that is uninsured, whichever is greater. For the 2014 calendar year, the penalty cannot exceed $285.00 per family. This tax penalty will be assed on the family’s 2014 federal income tax return, which is due on April 15, 2015. This is how the Individual Mandate tax will be assessed for all future years as well.

The tax penalty will increase every year that a person chooses not to sign up for insurance and comply with the law. In 2015, the penalty will increase to $325.00 per uninsured adult and $162.50 per uninsured child or 2% of the annual household income excluding the tax-filing threshold amount, whichever is greater.

The tax penalty for 2016 will increase even more to $695.00 per uninsured adult and $347.50 per uninsured child or 2.5% of the household income above the annual tax-filing threshold, whichever is greater.

If a person is only without insurance for three months or less in any given year, they will not be taxed for violating the law. In addition, the tax will be proportionally assessed based on the number of months of the year of uninsured status. Therefore, if the person was only without healthcare for half of the year, they will only be penalized with half of the tax.

A person with health coverage in place before the Obamacare requirements started may still be in violation of the law if their insurance coverage did not include the ten essential health benefits required under the law. The reason that President Obama included these ten essential health benefits in the law is to ensure that no matter whether a person could only afford the lowest level policy or signed up for a platinum level policy, both could rest assured that their insurance company would have to cover certain services

The ten essential health services are:

- Ambulatory Patient Services

- Emergency Services

- Inpatient Hospitalization

- Maternity and Newborn Care

- Mental Health and Substance Use Disorder Services

- Prescription Drug Coverage

- Rehabilitative and Habilitative Services

- Laboratory Services

- Preventative and Wellness Services and Chronic Disease Management

- Pediatric Services Related to Oral and Vision Care

In addition to these ten essential healthcare services, Obamacare also mandates that no insurance company can deny a person coverage for a preexisting health condition, can cancel a policy because a person got sick, cannot discriminate on any person based on gender, race, financial situation, medical history or disabilities when determining premium amounts, cannot cap annual or lifetime claim payouts, and must allow kids to remain on their parent’s health insurance coverage until their 26th birthday. These additional benefits cause many people a sigh with relief as things like getting sick and being dropped from your insurance or being denied new coverage because of a pre-existing health condition were often a source of stress and caused major issues during the pre-Obamacare days.

Not every person living in the United States is required to get health insurance under the Affordable Care Act law. There are certain groups of people who are completely exempt from having to get health insurance.

Those people are:

- Native Americans or Alaska Natives

- A member of a federally recognized healthcare sharing ministry

- A member of a federally recognized religious sect that opposes health insurance

- Illegal immigrants

- Americans who have only been without health insurance for three months or less

- Americans under the age of 26 who can still be on their parent’s health insurance

- Americans who are exempt from filing federal income tax returns according to the IRS

- The lowest-priced insurance policy offered through the Marketplace on Healthcare.gov is 8% of your yearly household income

- You qualify for a hardship exemption

If a person believes that they qualify for an exemption can either simply proclaim the exemption on their federal tax return or they can submit an application before the deadline to determine whether their circumstances are approved for an exemption. The issue with simply advising the government of your exemption on your tax return is that the deadline to sign up already passed and if you are denied the exemption, you will be taxed for a full year of failing to have insurance.

There are four ways to sign up for health insurance under Obamacare. You can either get coverage through your employer, you can sign up for a policy with a private health insurance company or you can sign up for a policy on the Healthcare.gov Marketplace if you live in a state that either partners with or entirely relies on the federal exchange to provide health coverage to its citizens, or you can sign up on your state’s health exchange marketplace if you live in a state that has taken on the management and administration of the Affordable Care Act on its own.

People who live in a state that relies on the federal Healthcare.gov Marketplace and who needs financial help to pay for their health coverage can receive help under the Affordable Care Act so long as their yearly income is within 100% and 400% of the federal poverty level. In terms of dollars and cents, a single person that is within this range would make $11,490 to $45,906 a year. A family of four would qualify for a federal subsidy if they made between $23,500 to $94,200 a year. Obviously the financial range varies per family size.

When you are filling out an application on Healthcare.gov for an insurance policy, you will need to approximate how much money you expect to make in that calendar year. It is important to be as precise as possible because if you underestimate your income and receive a federal subsidy for which you were not actually entitled to, this information will be disclosed on your tax return for that year and you will have to pay the federal subsidy amount back.

If a person makes less than 100% of the federal poverty level and they live in a state that did not take President Obama’s recommendations in the Affordable Care Act to expand the eligibility requirements for Medicaid, they will qualify for coverage through Medicaid. If a person makes less than 133% of the federal poverty level and they live in a state that did take President Obama’s recommendation to expand the eligibility requirements, they can sign up for Medicaid through the Marketplace. Originally the Affordable Care Act required all states to expand its eligibility requirements or they would be penalized, however the Supreme Court found this provision to be unconstitutional and had it stricken from the Act.

If a family with children makes a little too much to qualify for Medicaid, their children may qualify for their state’s CHIP program. If their children qualify for CHIP, that information will be disclosed at the close of the application submission on Healthcare.gov.

Aside from the Individual Mandate, Obamacare also imposes requirements on business owners with a certain number of full-time employees. The Affordable Care Act does not mandate that employers provide health coverage to their full-time employees but does offer incentives to small business owners who do offer health insurance and imposed a penalty called an Employer Shared Responsibility Payment on larger businesses who choose not to insure their employees.

If you have fewer than 50 full-time employees and do not provide your employees insurance, the business owner will not have to make a Employer Shared Responsibility Payment. Any employee who works for a company that does not offer health coverage will receive a subsidy to sign up for a policy under the Healthcare.gov Marketplace. Any small business owner that does offer their employees with health insurance will get a tax credit for doing so.

In addition, the Affordable Care Act created a special Marketplace specifically for small business owners to shop for health insurance for their employees. This Marketplace is called SHOP (Small Business Health Options Program).

Closing Thoughts On The Obamacare Chip Hoax

In closing, the Obamacare Chip is without a doubt 100% hoax, rumor and nothing more than people making money from scaring honest Americans who are concerned about their healthcare options. Don’t feed into the lies, and by all means, don’t help unethical individuals profit from spreading lies.

Credit to Obamacare.net for the hilarious image.